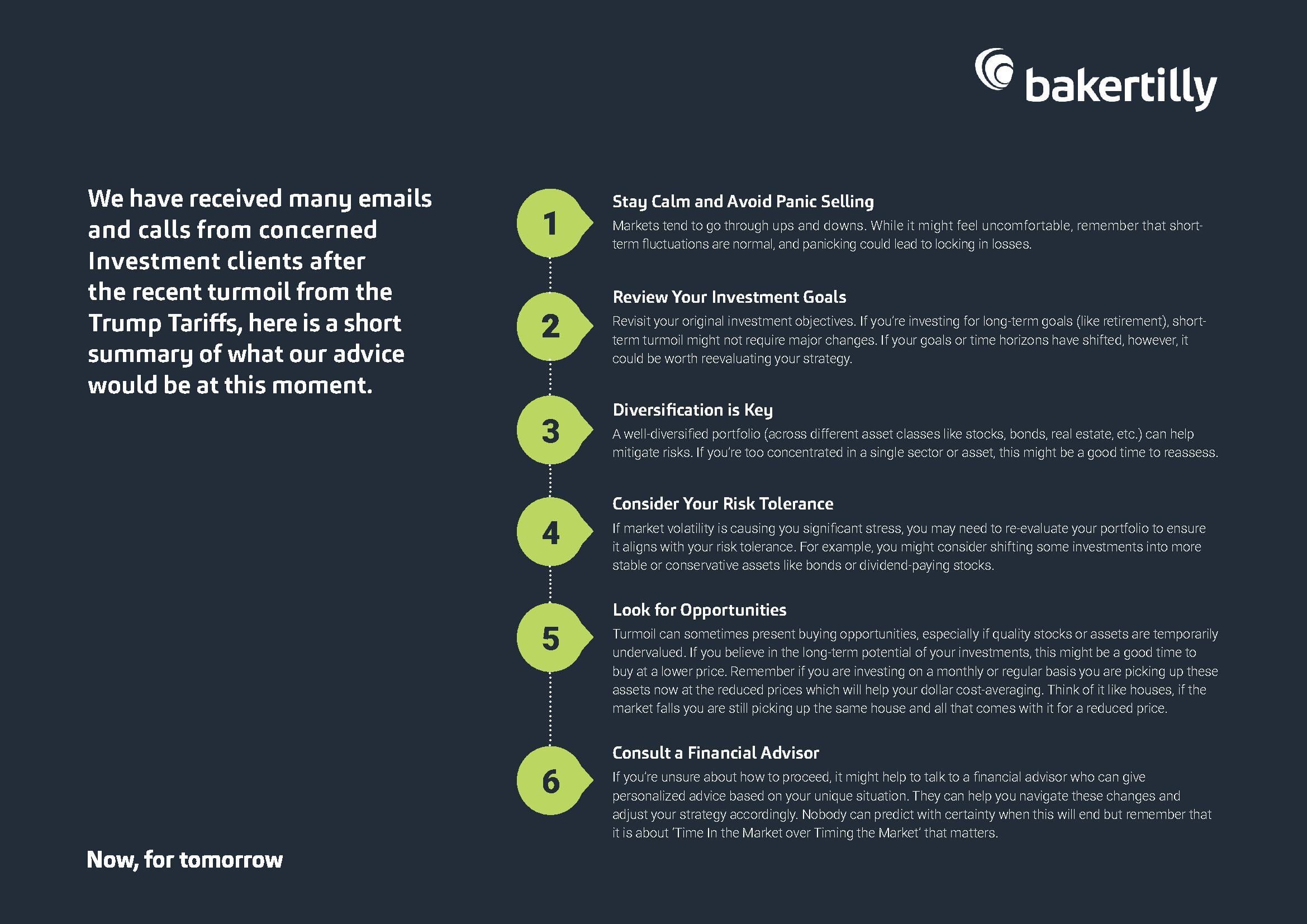

In light of the recent turmoil caused by the Trump tariffs, we have received numerous emails and calls from concerned investment clients. To address these concerns, we have compiled a short summary of our current advice for investors navigating these uncertain times. Below, you will find a list of tips to help you make informed decisions and safeguard your investments.

1. Stay calm and avoid panic selling

Markets tend to go through ups and downs. While it might feel uncomfortable, remember that short-term fluctuations are normal, and panicking could lead to locking in losses.

2. Review your investment goals

Revisit your original investment objectives. If you're investing for long-term goals (like retirement), short-term turmoil might not require major changes. If your goals or time horizons have shifted, however, it could be worth revaluating your strategy.

3. Diversification is key

A well-diversified portfolio (across different asset classes like stocks, bonds, real estate, etc.) can help mitigate risks. If you’re too concentrated in a single sector or asset, this might be a good time to reassess.

4. Consider your risk tolerance

If market volatility is causing you significant stress, you may need to re-evaluate your portfolio to ensure it aligns with your risk tolerance. For example, you might consider shifting some investments into more stable or conservative assets like bonds or dividend-paying stocks.

5. Look for opportunities

Turmoil can sometimes present buying opportunities, especially if quality stocks or assets are temporarily undervalued. If you believe in the long-term potential of your investments, this might be a good time to buy at a lower price. Remember if you are investing on a monthly or regular basis you are picking up these assets now at the reduced prices which will help your dollar cost-averaging. Think of it like houses, if the market falls you are still picking up the same house and all that comes with it for a reduced price.

6. Consult a financial advisor

If you're unsure about how to proceed, it might help to talk to a financial advisor who can give personalized advice based on your unique situation. They can help you navigate these changes and adjust your strategy accordingly. Nobody can predict with certainty when this will end but remember that it is about ‘Time In the Market over Timing the Market’ that matters.